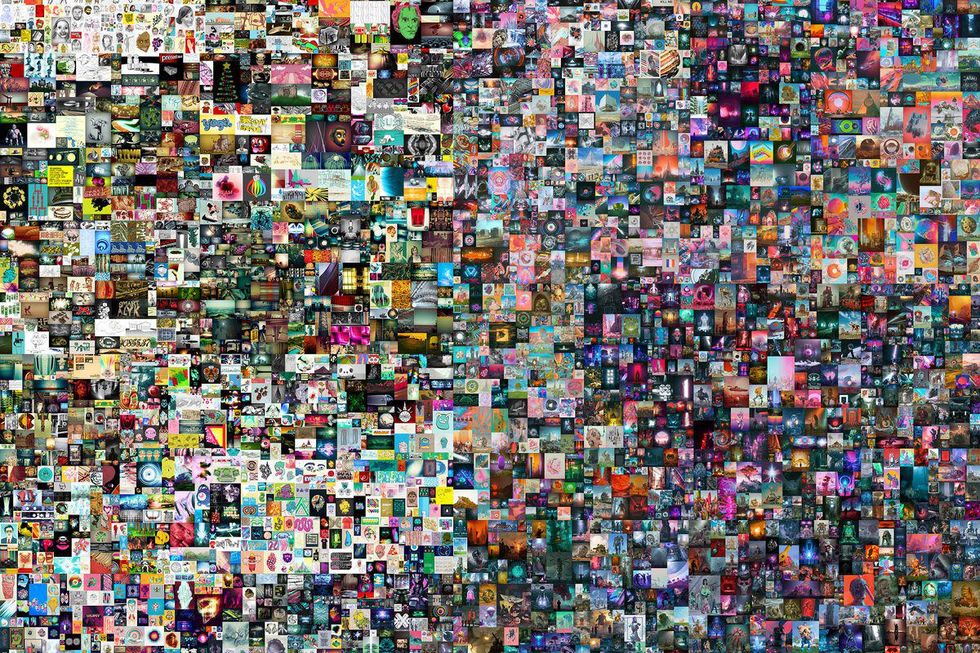

Art Installation N°1 by Carlos Marcial. Rhett Dashwood / YouTube

If you’re keeping tabs on the art and tech worlds, you’ve probably been hearing whispers about “NFTs” for the past month. Just over the past week they’ve entered the mainstream lexicon.

Twitter founder Jack Dorsey made the news for selling his first ever tweet. The app has been teasing paid subscription models and newsletter-like features, but tweets for sale is “the next frontier.”

The 2006 tweet went up for auction as an NFT, and the current bid is $2.5 Million. But what does it mean to own that? Why would anyone want to? And what even is an NFT?

What does NFT stand for?

NFT stands for “non-fungible token.” Essentially, it’s like a proof of ownership sticker for something that exists on the internet. The NFT is a piece of code that acts like a watermark or a signature — if you own an NFT, you own the rights to that little piece of the internet. Because ownership is embedded into unique code on a blockchain, NFTs are impossible to make fakes of or replicate. The digital asset can be screenshotted or replicated, but the ownership cannot.

An NFT is different from a “fungible token,” like a Bitcoin. The main distinction is that fungible tokens are interchangeable. They each have a 1:1 value with each other, but NFTs do not. So while one Bitcoin has the same exact value as another, an NFT of a random Popdust tweet does not have the same value of Jack Dorsey’s inaugural tweet.

Talk of NFTs is often intertwined with cryptocurrency jargon, but they are not only the realm of Bitcoin bros. Unlike other forms of cryptocurrency, you don’t need to know the specific ins and outs of the market in order to purchase an NFT — making NFTs accessible to those of us who have yet to hop onto Bitcoin, Ethereum, or even Dogecoin.

What Can Be an NFT?

Any digital asset can become an NFT. From a tweet to a gif to digital art, anything that exists on the internet can now be officially owned. NFTs have been around for a while, but only recently have they taken off as a way for digital creators to sell “official” versions of their content.

Anyone can screenshot a tweet or repost an Instagram meme, but NFTs allow consumers to own the rights to trade, sell, or keep and collect them. While digital art and internet ephemera are most ubiquitous as NFTs, the market is growing for more traditional collection fodder to be sold in this new format.

Digital art is now being sold like fine art, and baseball cards are no longer the realm of middle school lunch tables. As the market grows, so does the scale. While an NFT gif can go for around $5,000, recent digital sales have been making headlines for reaching millions and tens of millions.

Why Are People Talking About Them?

While Dorsey is not the first to rack up millions for selling digital ephemera, his tweet auction has propelled the market into the headlines. The hype surrounding the NFT market is similar to the recent astronomical trajectory of cryptocurrency and has even been compared to the GameStop saga.

In one way, NFTs are similar to investments like fine art and rare collectibles. And the traditional auction world is taking notice. Digital artist Beeple, who has been creating Everydays for 13 years and amassed millions of social media followers, is finally getting payout for the work he has been doing for free. Internationally renowned auction house Christie’s launched its first ever digital-only auction with a Beeple NFT.

It sold for $69 Million.

While the astronomical prices may be driven by hype, the future of NFTs is becoming undeniable.

What’s the Future of NFTs?

NFTs are changing the way artists and digital creators interact with followers and get paid. Soon we’ll be seeing branded NFTs collected like Jordans or even NFTs to replace tour merch. Music NFTs are already making waves, too.

They’re also changing the way we think about investing. Instead of investing in the stock market or in the traditional collectibles, internet fodder can now appreciate in value. And because so many NFT platforms serve crypto users, investors can watch the value of their items and their crypto rise separately to compound their earnings.

However, the unregulated world of NFTs is rising without anyone keeping vigilant watch. The murky waters of internet ownership that NFTs ostensibly solve get muddied when people are stealing art to turn into NFTs in the first place.

And while NFTs are purportedly decentralizing and democratizing art dealing and trading, the reality seems like the people benefitting are already rich and looking to get richer.